PACE 101 - What is the PACE Program?

PACE is an acronym for Property Assessed Clean Energy.

Executive Summary: A PACE project enables owners to finance 100% of their energy saving or water conserving improvements. The method used is similar to that used to finance schools, sewers, and economic revitalization programs. The entire loan is called a PACE Loan Assessment The annual repayment is done via a line item on the annual property tax bill. That annual repayment is called an Annual Assessment. It is just an additional annual tax payment that reflects your investment (using investor funds) in your own property. If you choose wise improvements, that is, those with positive cash flow, both your new lenders and your existing lenders may indeed view your investment as a win-win opportunity.

New and existing lenders like PACE because most often the program immediately improves cash flow, Net Operating Income and the quality of the asset. Furthermore, the annual PACE assessment cannot be accelerated so while the property (their security) receives the full benefit of the investment on Day 1, only the annual assessment currently due is ahead of the existing mortgage.

Owners like the program because it is cash flow positive on Day 1 and the annual assessment can usually be passed through to the tenants, who benefit from the lower utility bills. This pass-through ability addresses a disincentive that owners have to improve property - that is, some leases do not allow for the owner to pass through to the tenant the full financing cost of the improvements. With PACE they may be able to pass through the full cost of the improvements, depending on the terms of the lease.

Owners who may be looking to sell the property like the fact that the financing stays with the property. Specifically, in the event the current owner should choose to sell the property, the current owner is not obligated to pay anything more than the Annual Assessment then due (plus, of course, any past due ones). This enables them to implement improvements with the assurance that the "Loan Assessment" balance will remain with the improvements they financed.

PACE eliminates useful life versus financing mismatch concerns. The funding will match the weighted average useful life of the property improvements. This lowers the annual assessments (loan payments) and enables an immediate positive cash flow.

This simple video from the national PACENow organization may help you to understand what the PACE program. PACE Houston is a local private PACE Facilitator located in Houston Texas that provides strategic advice to its clients.

A building owner will do a PACE project if the annual benefits to him are greater than the costs to him. The reason is a PACE energy efficiency project increases the properties NOI and building value. SIR stands for Savings to Investment ratio. The idea is what you save in utilities must be greater than your payments.

There are several methods for validating the SIR hurdle required for a PACE Project. Here is a link to a video that tells Why a Commercial Property owner may consider doing a PACE Project. It is produced by the national PACENow organization.

You may skip these additional SIR and NSIR details for now but here they are. The property improvement may be evaluated by calculating the property's prospective NOI with and without the improvements. Here are some quick ways to look at the improvement, just including the flows related to the improvement.

SIR: The Savings to Investment Ratio must be greater than "1". The Savings is calculated as the sum of the savings over the useful life of the project. The Investment is calculated as the Principal value of the Investment. This is the least conservative ratio because it does not take into account the time value of money. The formula is:

SIR = Sum of the Annual Utility Savings/Principal Value of the Loan

NSIR: This ratio is a modification of the SIR. It takes into account time value of money in calculating both the expected annual savings and the future P&I. This has the effect of reducing the Utility Savings based on the discount rate you select. You may want to use a higher discount rate for the utility savings to reflect the fact that the annual assessment amounts are certain and the utility savings less certain.

NSIR = Present Value of the Sum of the Utility Savings/Principal Value of the Loan

Let’s look at the two parts of PACE acronym, Property Assessed Clean Energy.

Clean Energy: The program is designed to support actions that reduce energy or water consumption and/or that increase renewable energy production.

Property Assessed: The improvements are funded by a loan for 100% of the cost of the improvements. The loan is repaid (amortized) through a local tax district via an annual tax assessment, equivalent to the annual P&I that would have been normally paid. An amount equal to the P&I is a line item on a regular tax bill.

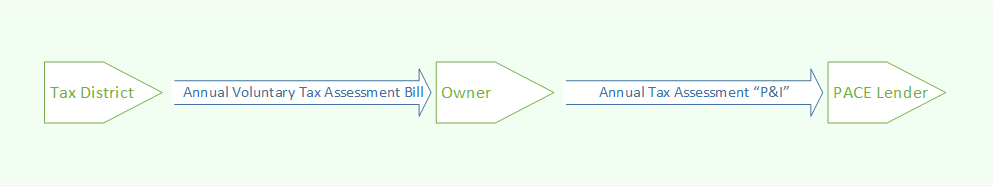

The PACE funding flow depends on a new class of national lenders, that is, those looking for long term fixed rate secured type investments that are energy conservation focused. The funding flow is as follows:

The annual P&I re-payments take the form of an annual tax assessment. The current owner will see the assessment on his tax bill just like he would see a sewer or water bond assessment. The lenders are repaid as the owner submits payments to the tax district (or directly to the Lender or the Texas PACE Authority). These pictures are conceptual - the actual flows may be handled by agents of the Lender or the Tax District.

NOTE: In Texas the Annual Assessment may go directly to the Lender or first to the Texas PACE Authority and then to the Lender. This can allow for more frequent P&I payments that the Annual Assessment. We believe this direct flow is unique among the states adopting PACE.

Energizing Energy Improvements

PACE addresses many issues that have stalled conservation or renewable's efforts.

1. Term Matches Useful Life: Many times the credit markets will not provide a borrower with a term loan that is sufficiently long enough to make the energy efficiency project cash flow positive. With PACE, the maturity of the loan matches the useful life of the improvements.

2. Loan Stays with the Improvements: Often the building owner does not want to incur long term debt even for a cash flow positive investment because the debt would have to be repaid if the owner sells the building. With PACE, the loan assessment stays with the property (and the improvements), even if the owner later decides to sell the property.

3. New Loan is Well Placed in the Capital Stack: Often new lenders will not lend on energy efficiency improvements because they do not want to take a second on the property. With PACE, the new lenders are generally on a pari passu basis with revenue bonds, or just below General Obligation bonds.

4. Existing Lenders Prefer the Better Cash Flow: Existing lenders are usually not willing to subordinate their interests to the new lender's debt for energy efficiency loans. However, with PACE they are willing to do so because the project improves the cash flow of the property and its Net Operating Income.

5. Only the P&I Assessment Due is Ahead of Existing Lenders: While the property receives the full value of the investment and the future cash flows, only the assessments due are ahead of the existing lender’s position. Furthermore, the assessment loan cannot be accelerated.

6. Tenants who Benefit from Lower Utility Bills Pay the Cost: In most leases an owner cannot pass the principal and interest cost of repaying a loan on to the tenants. Unfortunately, this owner disincentive has kept many owners from doing improvements that would have lowered the tenant's utility bills. However, some lease contracts allow annual tax assessments to be passed on to the tenants. Since a PACE loan repayment is actually via a tax assessment, the cost of the improvements can often be passed on to the primary beneficiaries of the lower utility costs, the building tenants.

7. Improved Property Values: Owners and Lenders usually prefer to continuously maintain or improve their property, if the capital is available. Doing so can not only improve the credit quality of the tenant but can also lower the Cap Rate of the property. This lowering of the Cap Rate can have a profound impact on the property's value. This was pointed out by Mr. Gerald Hines as a primary reason for doing a PACE deal.

In summary, the main differences in PACE lending that makes energy efficiency projects doable are the term matches the useful life, the assessment stays with the property if the property is sold, the new loan’s P&I payments are positioned directly behind General Obligation bonds, the project improves the property’s cash flow and property value, only the annual P&I due is ahead of the existing lenders, the loan cannot be accelerated and those who receive the benefits pay for those benefits.

How to Get Started

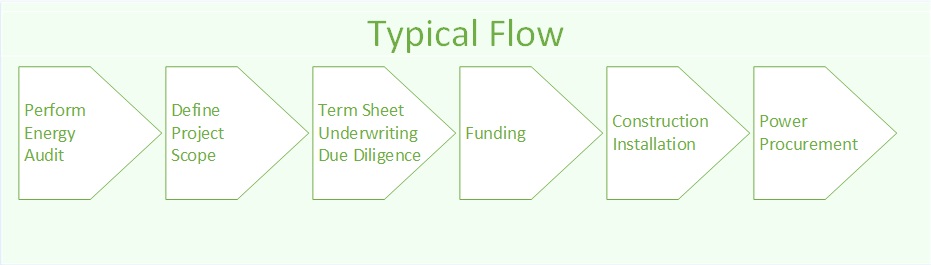

This simple flow chart shows the process for getting started. Some of these steps can occur in parallel or even in a slightly different order. Working with PACE Houston, the owner or property manager can decide on an economically viable product and begin the implementation process.

While a PACE deal is conceptually straightforward - the property owner tentatively decides on an energy improvement project, validates the costs/benefits, works directly with lenders to obtain funding, pays the contractors and then repays the loan - a typical start to finish product involves many different participants.

The owner may enlist the services of an architect to plan a major renovation or a MEP engineer to determine the best combination of energy improvements. Alternatively, PACE Houston can provide access to cutting edge Energy Modelling and Simulation that uses a physics based approach incorporating power measurement, weather patterns and usage. This enables a property owner to determine the optimal improvements and then simulate changes. Contractors can then be managed by either the owner or with the hands on management of a PACE Houston project manager partner. Advising you of these activities can be a PACE project developer like PACE Houston. We would also coordinate with the Texas PACE Authority.

More Detailed Project Steps

Legend for More Detailed Project Steps

1. Engage Facilitator as a Strategic Advisory

2. Perform Energy Modelling and Simulation

3. Develop Project Scope

4. Obtain Contractor Pricing

5. ITPR Validation

6. Owner works with their selected Lender - Underwriting, Due Diligence & Receives Preliminary Commitment

7. Calculate Project Economics

8. Lender and Owner work together to Obtain Lender Consent

9. Obtain Government Administrator’s Approval

10. Record Assessment

11. Complete Construction

12. Owner's Lender Funds Advances(s) under the Loan Assessment

13. Tax Bill includes new Line Item To Repay Lender

14. Owner Pays Annual Tax Bill

15. Calculate Net Benefit to Property and Tenants

16. Post Project ITPR Verification

A PACE Loan Assessment remains with the Property if Owner sells the property - effectively a PACE loan is assumable by the new owner who will be receiving the benefit of the improvements.

To learn more about What types of Properties and Improvements Qualify for PACE please see the FAQ Page.

In today's market we greatly benefit from low energy prices, low interest rates and adequate liquidity in the market. We simply address the current perfect storm for doing a PACE deal in our Power Procurement page.