Which Lenders have agreed to a PACE Assessment?

Consenting Lenders

(A Consenting Lender is an existing lender, usually a first mortgage holder, who must agree to the PACE assessment (the new loan).

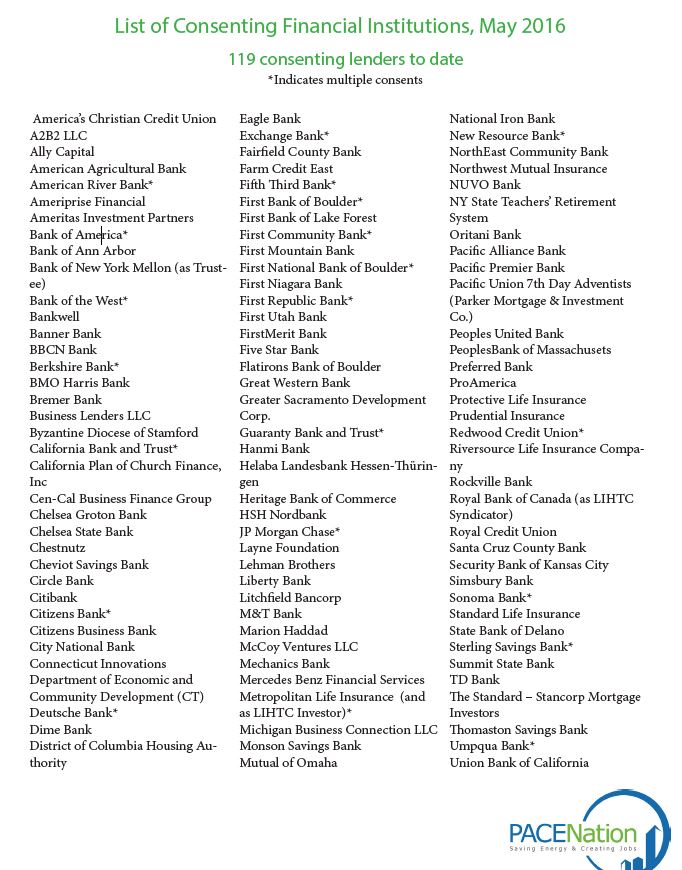

One of the questions we receive is "Which lenders have agreed to a PACE assessment?" The list below is excerpted from the PACENow Lender Support Update.

The underlying question is "Why would a lender agree to subordinate their interests to a new PACE loan?" Many PACE lenders note that a PACE loan is an assessment - while it is - all tax liens are superior to any debt on the property. So why would an existing first mortgage holder agree to a PACE Assessment.

The answer is simple: The property receives the benefit of 100% of the improvements while only the annual assessment payment(s) due are ahead of the existing lender's position.

When an owner improves a property two things can happen:

1. Operating Costs Decrease

2. Revenues Increases

Either one improves the property cash flow and value and can lower the cap rate. Lowering the cap rate can have a large effect on the property value. Improving the quality of the property may also over time improve the credit quality of the tenants with a follow on improvement in the quality of the cash flow.

Improved cash flow, property value, an improved tenant profile and a lower cap rate all go into making an existing lender want to support a property owner's efforts to improve their collateral value.

This is evidenced by a growing list of existing mortgage lenders who have consented to a PACE loan assessment.

For more information please review the PACENow Lender Support Update.